contra costa county sales tax calculator

Welcome to the Tax Portal. CA is in Contra.

California Sales Tax Rates By City County 2022

Contra Costa County in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Contra Costa County totaling 075.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To build the countywide tax roll and allocate and account for property tax apportionments and assessments for all jurisdictions in. Peruse rates information view relief programs make a payment or contact one of our.

Sales Tax Table For Contra Costa County California. CA is in Contra Costa County. The minimum combined 2022 sales tax rate for Contra Costa County California is.

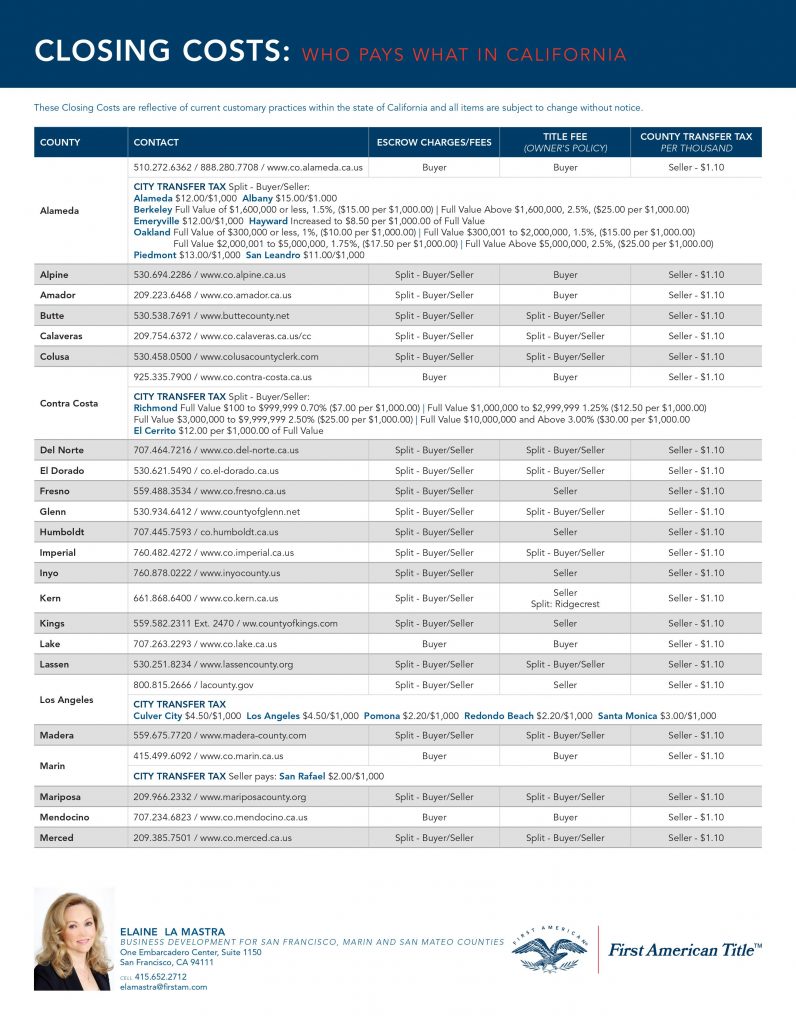

California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. The base sales tax in California is 725You can also use Sales Tax calculator at the front page where you can fill in percentages by. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025. This rate includes any state county city and local sales taxes. The sale of Tax-defaulted Property Subject to Power of Sale is conducted by the Contra Costa County Treasurer - Tax Collector pursuant to the provisions of the Revenue and Taxation Code.

What is the sales tax rate in Contra Costa County. If you think the value of the property is incorrect please contact the Assessors Office at 925-313-7600. The Contra Costa County California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Contra Costa County California in the USA using average.

2020 rates included for use while preparing your income tax deduction. The voter-approved bonds that make up the tax rate cannot be changed. A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the. Denotes required field. Weve collated all the information you need regarding Contra Costa taxes.

The December 2020 total local sales tax rate was 8250. 2020 rates included for use while preparing your income tax deduction. CA Rates Calculator.

This rate includes any state county city and local sales taxes. US Sales Tax calculator California Contra Costa. Watts was first elected in June 2010 as Treasurer and Tax Collector of Contra Costa County Watts is responsible for the collection safeguarding and investment of over 35.

Welcome to the TransferExcise Tax Calculator. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 923 in Contra Costa County. The Contra Costa County Sales Tax is 025.

See pricing and listing details of Mountain View real estate for sale. View 16 homes for sale in Mountain View Contra Costa County CA at a median listing home price of 1580000. The purpose of the Property Tax Division is.

Calculator Mode Calculate. The current total local sales tax rate in Contra Costa County CA is 8750. For comparison the median home value in Contra Costa County is.

For a list of your current and historical rates go to the California City. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. CA Rates Calculator.

Method to calculate Contra Costa County sales tax in 2021. This is the total of state and county sales tax rates.

Where Your Property Tax Dollars Go Contra Costa County Ca Official Website

San Diego County Ca Property Tax Faq S In 2022 2023

Sales Taxes How Much What Are They For And Who Raised Them

School Bond Tax Rates By School District In Contra Costa County

Food And Sales Tax 2020 In California Heather

![]()

Tax Credit Calculator My Free Taxes

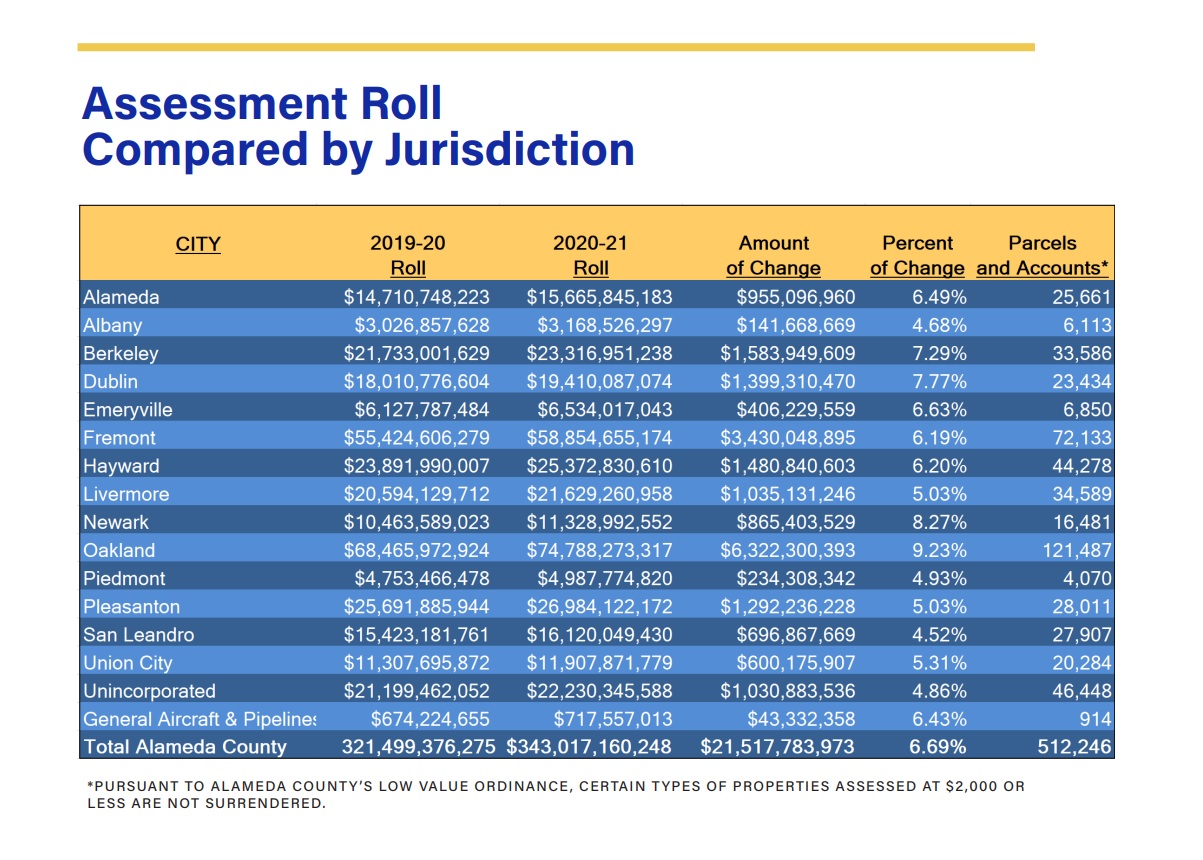

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

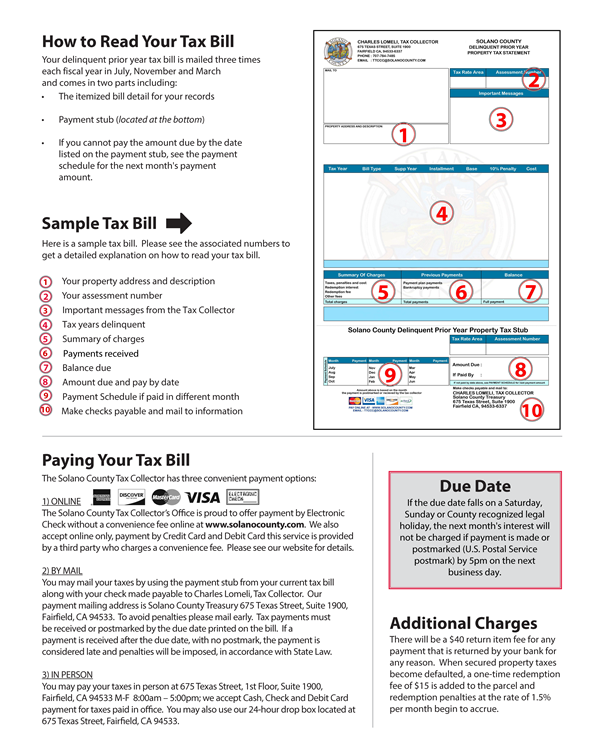

Solano County Delinquent Prior Year Tax Bill

Property Tax By County Property Tax Calculator Rethority

What You Should Know About Contra Costa County Transfer Tax

55 Threshold For Transportation Measures California Association Of Councils Of Governments

Understanding California S Sales Tax

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

California Vehicle Sales Tax Fees Calculator

New Sales And Use Tax Rates In Newark East Bay Effective April 1 Newark Ca Patch

No April Fools Joke City Sales Tax Rises To 10 25 April 1 El Cerrito Ca Patch

California Sales Tax Rate By County R Bayarea

How To Calculate California Sales Tax 11 Steps With Pictures