is there a child tax credit for december 2021

The payment for children. You can claim up to 500 for each dependent who was a US.

Parents Guide To The Child Tax Credit Nextadvisor With Time

Under the expansion low- and middle-income.

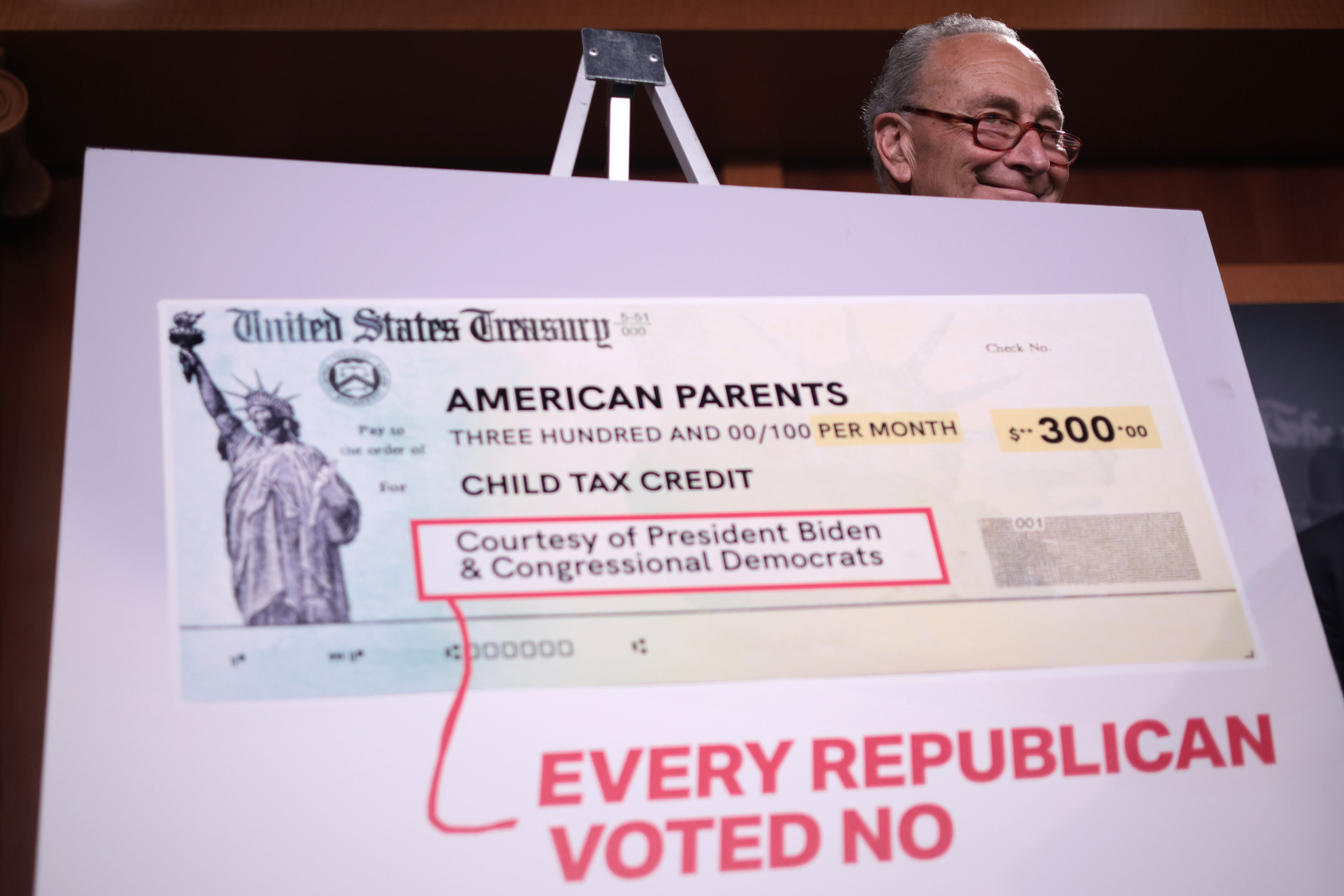

. If a 17 year old dependent turns 18 during 2021 then they would not be eligible for the advance tax. The Democrats 19 trillion coronavirus relief package which Biden signed into law in March made three significant changes to the child tax credit for 2021. But as part of the 19 trillion coronavirus relief package President Joe Biden expanded the program increasing the payments to up to 3600 annually.

Child tax credits are available for low- and moderate-income families to help offset the costs of children and for qualifying filers this can mean significant amount of money back for having children. For example if a 5 year old child turns 6 during 2021 as of December 31 2021 that dependent would fall into the age 6-17 bracket. Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit and Topic E.

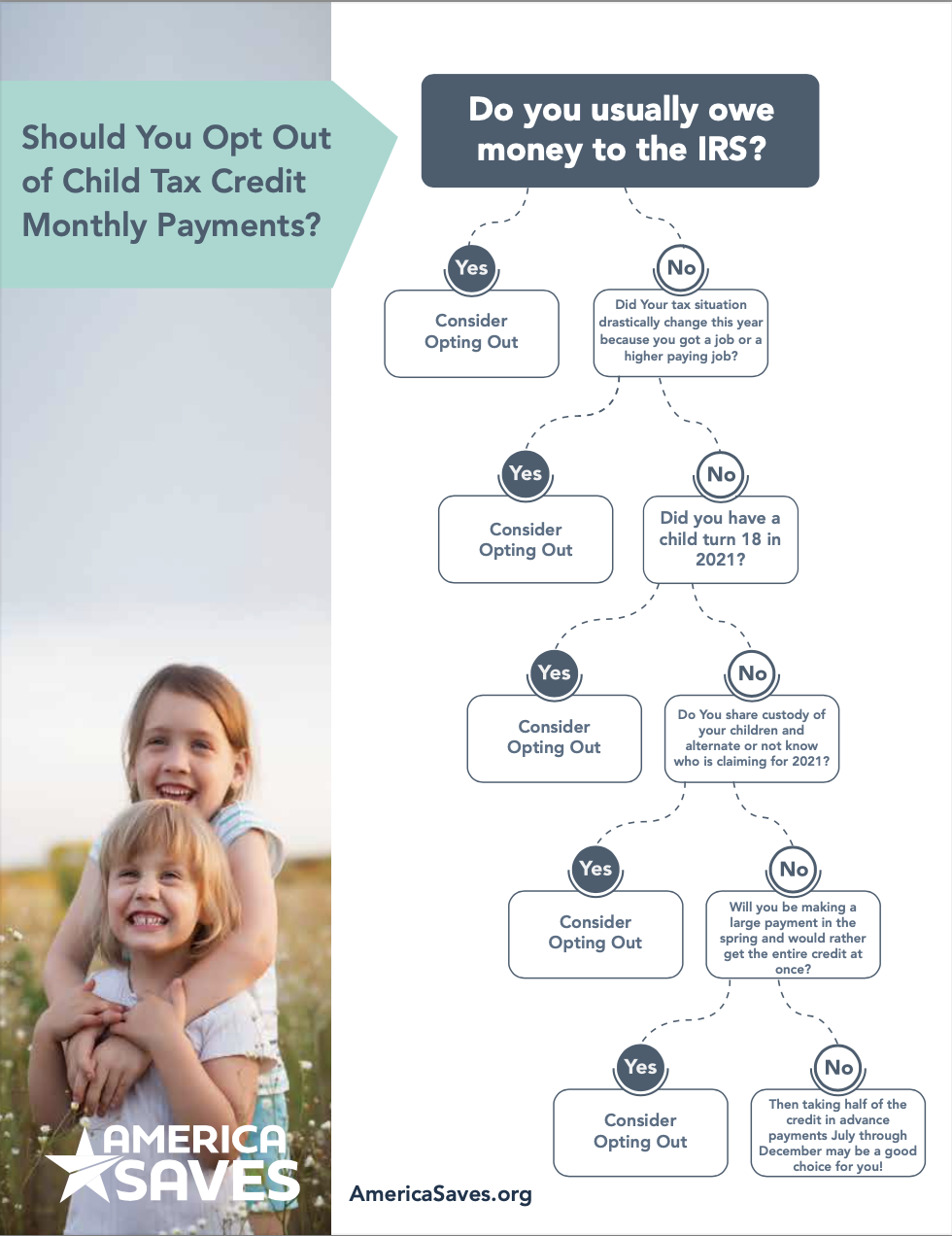

The final 2021 child tax credit payment gets sent directly to Americans on December 15 Credit. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Unlike the regular Child Tax Credit there is no 2021 taxable income requirement to be eligible to claim the advance child tax credit.

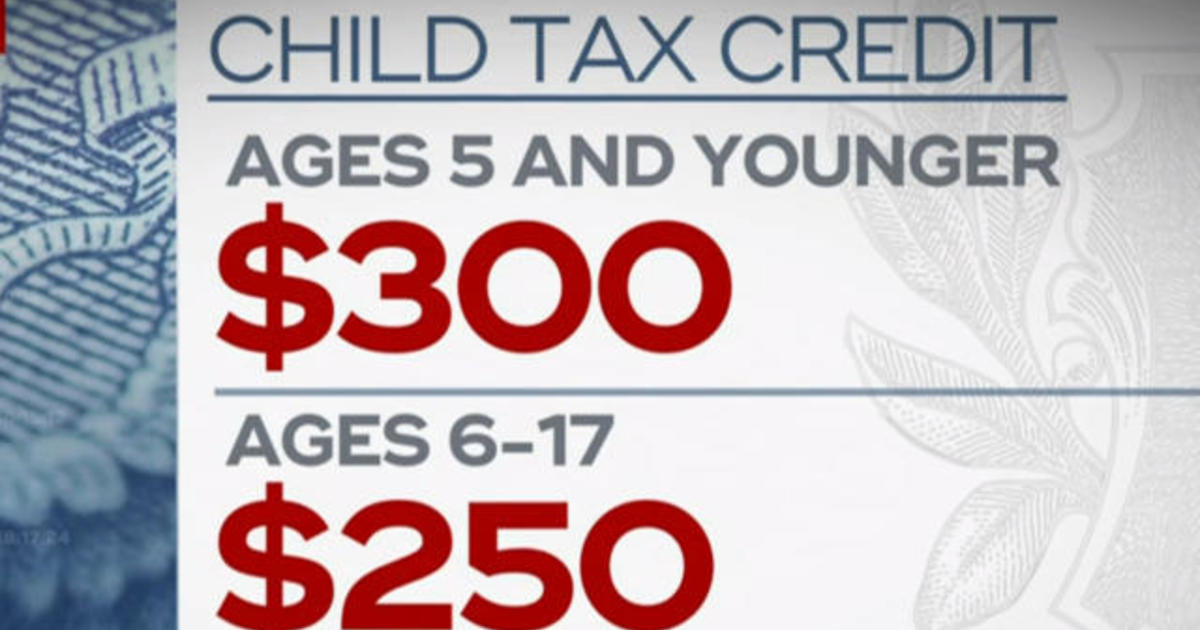

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income. Did I need income to receive advance Child Tax Credit payments. Resident alien in 2021.

The much-needed relief money made possible with the help of President Joe Bidens 19trillion American Rescue Plan has been going out Americans across the country since the COVID-19 Stimulus Package was signed into law in the spring. Advance Payment Process of the Child Tax Credit. You may be eligible to claim the Credit for Other Dependents.

How much will I receive from the Child Tax Credit. Even if you had 0 in income you could have received advance Child Tax Credit payments if you were. Democrats temporarily expanded the child tax credit in early 2021 as part of a sweeping coronavirus relief package but it expired at the end of 2021.

For the last six months 36 million families received a monthly check from the IRS through the expanded Child. Learn what the changes are who qualifies payment amounts and when those payments will be issued. Updated January 11 2022 A3.

What the child tax credit enhancement means for families and the US. From July to December eligible families received monthly payments of up to 300 per month for each child. It increased the maximum credit to.

The Child Tax Credit CTC for 2021 has some important changes stemming from the American Rescue Plan ARP. For each qualifying child age 5 and younger up. Your amount changes based on the age of your children.

Additional information about the IRS portal allowing you to follow update or even opt-out of the new payments will also be provided. How much is the child tax credit worth. One of the largest changes for The Tax Cuts and Jobs Act of 2018 has to do with the changes to the child tax credit.

The Credit for Other Dependents is a tax credit available to taxpayers for each of their qualifying dependents who cant be claimed for the Child Tax Credit. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or. It depends on how old your children are and how many children you have.

For each child 6-17 years old you will receive 3000 total or 250 per month from July to December 2021. The advance child tax credit passed as part of the American Rescue Plan in March 2021.

Five Facts About The New Advance Child Tax Credit

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Child Tax Credit 2022 How To Claim A Missed Ctc Payment Marca

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit 2022 What Will Be Different With Your Payments Next Year Marca

The 2021 Child Tax Credit Implications For Health Health Affairs

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit December Will This Week S Payment Be The Last One Marca

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

2021 Child Tax Credit Advanced Payment Option Tas

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check